Donald Trump Jr.-Backed Thumzup Media To Acquire Dogecoin And Litecoin Mining Firm Dogehash For $154M

Thumzup Media Corp, which counts Donald Trump Jr. as a major shareholder, is pivoting from digital marketing into industrial-scale Dogecoin mining through its all-stock acquisition of Dogehash Technologies.

According to an announcement by the media company, the deal will see Dogehash shareholders offer up 100% of their holdings in exchange for 30.7 million Thumzup shares. This values the deal at around $153.8 million based on the company’s closing price.

In addition to Dogehash shareholders receiving Thumzup shares, the two companies will also merge into one entity and rebrand as Dogehash Technologies. This new company will then list on Nasdaq under the ticker “XDOG,” pending shareholder approval that is expected in Q4 of this year.

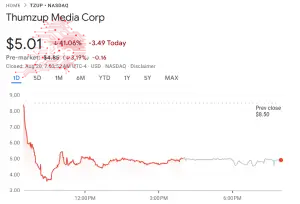

The deal comes amid a strong selloff of Thumzup stock. Just yesterday, the company’s shares plummeted more than 41% to close the trading session off at $5.01, data from Google Finance shows. The selling activity continued in after-hours trading, with the stock price sliding another 3% during this period.

Thumzup Media Corp share price (Source: Google Finance)

That drop has pushed the stock’s loss over the past week to more than 51%, while also extending its weekly losses to over 64%.

Dogehash And Thumzup Aim To Create Leading Crypto Company

Dogehash is an industrial-level crypto mining firm that focuses specifically on tokens running on the Scrypt algorithm, which the company says delivers stronger mining power-to-revenue efficiency than Bitcoin mining.

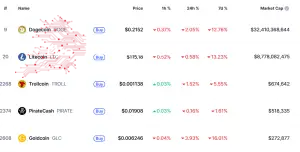

Specifically, the company mines Dogecoin (DOGE) and Litecoin (LTC), which are the two biggest Scrypt-powered assets, according to CoinMarketCap.

Largest Scrypt assets by market cap (Source: CoinMarketCap)

DOGE leads the way with its market cap of more than $32 billion, while LTC’s total valuation stands at about $8.77 billion.

The company currently operates around 2,500 Scrypt ASIC (Application-Specific Integrated Circuit) miners that are housed in a data center in North America. There are plans to scale operations throughout 2025 and into 2026.

That data center is powered by renewable energy as well, enabling Dogehash to achieve “significant Dogecoin and Litecoin block rewards with a low-cost, high-uptime footprint,” according to the announcement by Thumzup.

With the new company, Thumzup aims to “become the world’s leading Dogecoin mining platform.” The firm also said it will use the Dogecoin layer-2 blockchain called DogeOS, enabling it to stake in decentralized finance (DeFi) products, enabling it to boost miner returns.

$TZUP and Dogehash aim to become the world's leading #Dogecoin mining platform and will leverage Dogecoin Layer-2 infrastructure via staking in DeFi products within the DogeOS ecosystem to enhance miner economics and amplify yield beyond base block rewards. 🚀…

— Thumzup Media Corporation (@thumz_up) August 19, 2025

The deal comes off the heels of Thumzup’s $50 million stock offering “to expand its crypto strategies.” A portion of this capital will be used “to buy mining rigs and accumulate digital assets,” the company said.

Trump Family Grows Crypto Mining Empire

The Dogehash acquisition is the latest move in the Trump family’s expanding crypto empire, specifically in the mining sector.

Earlier this year, Eric Trump and Donald Jr. launched American Bitcoin in partnership with Hut 8, which has over 60,000 mining machines.

The Trump’s have a combined 20% stake in the business, while the remaining 80% will go to Hut 8.

At the start of the month, that crypto mining company bought a fleet of 16,299 Antminer U3S21EXPH units from Bitmain, which are capable of 14.02 exahashes per second (EH/s). The machines were purchased for approximately $314 million as part of a deal that excluded any potential price increases from the Trump administration’s sweeping tariffs and import duties.

Trumps Enter Into Billion-Dollar Deal With ALT5 Sigma

The Trumps are not just expanding their crypto empire through mining. Recently, another one of their ventures, World Liberty Financial (WLF), struck a $1.5 billion deal with ALT5 Sigma to inject its WLFI token into the firm’s treasury.

However, reports recently started surfacing that the US Securities and Exchange Commission (SEC) launched a probe into venture capitalist Jon Isaac for allegedly inflating earnings and participating in insider share sales linked to ALT5’s treasury financing for WLF.

Hours after the reports emerged, ALT5 responded on X and denied that Isaac was ever president or an adviser to the company. It also stressed that it had no knowledge of any ongoing SEC investigation into its activities.

ALT5 Sigma has been made aware of reports in the press and on social media. For the record: Jon Isaac is not –– and never was –– the President of ALT5 Sigma and he is not an advisor to the company. The company has no knowledge of any current investigation regarding its activities…

— ALTS (@ALT5_Sigma) August 19, 2025

Related Articles:

- SEC Delays Donald Trump’s Truth Social Bitcoin And Ethereum ETF

- Google Boosts Stake In Bitcoin Miner TeraWulf To 14%, Shares Hit 52-Week High

- Investors Are Shifting Back To NFTs – Here’s Top Selling NFTs This Week

Comments

Post a Comment