Bitcoin price prediction for November, according to BTC historical returns

Bitcoin (BTC) has opened November surpassing the $70,000 psychological resistance after holding a few days above this level. As this new month starts, Finbold looked at Bitcoin’s historical returns to provide a BTC price projection for November 30.

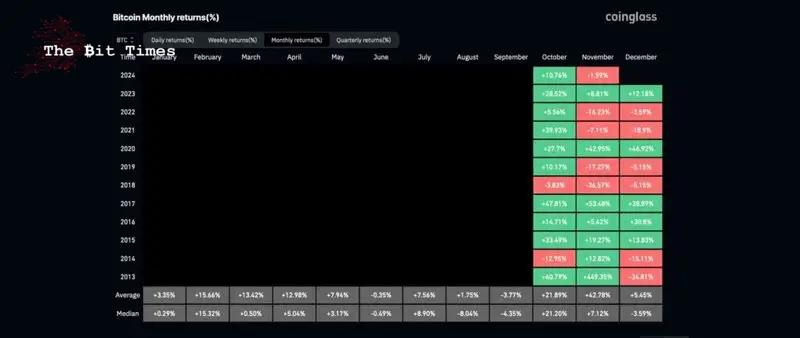

In hindsight, Bitcoin closed October with 10.76% gains, achieving nearly half the average and median historical returns for “Uptober.” Data from Coinglass shows November has even higher average historical returns while having lower median gains than its previous month.

Notably, Bitcoin’s monthly performance in November, dating back from 2013, has accumulated 42.78% gains on average. With seven positive years out of eleven, November also has a median return of 7.12%, from opening to closing.

Picks for you

In particular, November’s best year was 2013 with staggering 449.35% gains from day one to 30, followed by 2017 and 2020, with 53.48% and 42.95%, respectively. Meanwhile, 2018’s bear market resulted in -36.57% returns in November for Bitcoin, being its worst year followers by 2019.

Bitcoin (BTC) price prediction by November 30

As of this writing, Bitcoin is trading at $69,495, below November’s opening price of $70,272. The leading cryptocurrency shows strength after breaking out of high and low time frame downtrends, successfully retesting the LTF.

Therefore, BTC could trade between $75,275 and $100,334 by the end of November, based on its historical returns. The prediction projects Bitcoin’s price from November’s opening using the median and average historical returns if BTC keeps its momentum.

While this Analysis should not be taken in isolation, Bitcoin’s historical returns offer valuable insight into what traders and investors could expect as this month’s price action unfolds.

Interestingly, Finbold shared two related analyses earlier this Saturday, November 2, looking at the $100,000 price target. First, the artificial intelligence (AI) ChatGPT forecasts BTC to reach this target by mid-to-late 2025. Alan Santana, in another Analysis, sees a similar outlook – although he believes this current rally could be a bull trap.

All things considered, Bitcoin price is impossible to predict with precision, as the market is extremely volatile and uncertain. Investors should understand what they are buying and consider multiple factors before making any financial decision.

Comments

Post a Comment