Bitcoin price risks ‘major volatility’ as 10K BTC hits exchanges

Bitcoin (BTC) returned to exchanges en masse on July 27 in a sign that “major volatility” could come next.

According to data from on-chain analytics firm Glassnode, intraday BTC exchange inflows have hit multi-month highs.

Trader warns of BTC price volatility “spike”

BTC price action continues to linger below $30,000, and traders have consistently warned that further downside could come next.

At current levels, Bitcoin’s largest-volume investor cohort, the whales, appear to be in a state of flux in an unclear market.

Now, with large tranches of coins on the move in recent days, attention is focusing on entities sending funds to exchanges — with the implication that selling pressure could increase as a result.

As noted by market observers, including James Straten, research and data analyst at crypto insights firm CryptoSlate, over 10,000 BTC in inflows on a single day represented the biggest one-day increase for several months.

“Yesterday, the most amount of Bitcoin went back onto exchanges since the SVB collapse in March,” he commented on July 28.

Straten referenced the fall of Silicon Valley Bank (SVB), which at the time sparked mass market uncertainty.

“Watch out for a spike in volatility!” popular trader Ali continued on the topic, alongside data from research firm Santiment.

“A large number of idle BTC has been exchanging hands over the past 24 hours, which coincides with a 10,000 BTC increase in supply on crypto exchanges.”

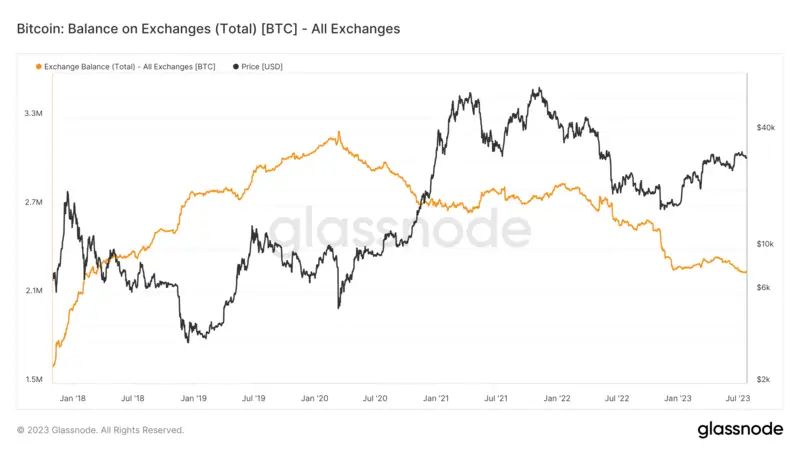

Glassnode shows that the changes took the combined BTC balance on the exchanges it monitors back above the 2.25-million mark.

Overall, however, balances remain at multi-year lows, having last circled 2.25 million in March 2018.

Bitcoin hodler cost basis in focus

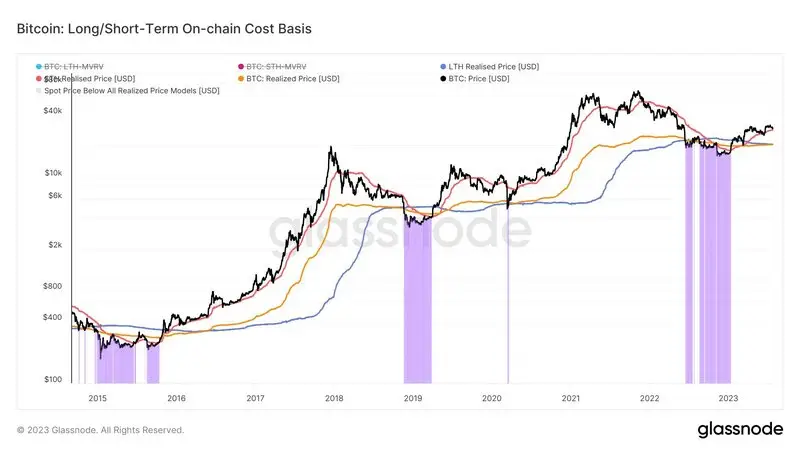

Continuing, Straten noted the ongoing influence of the cost basis of various hodler cohorts over BTC price.

Related: Bitcoin bull run next? Bitfinex stablecoin ratio ‘blows up’ in 2023

The cost basis of both short-term and long-term holders, already on the radar at Glassnode and elsewhere, remain important support levels.

“Bitcoin long-term holders have reduced their cost basis to $20,490. This is the lowest cost basis since April 2022. Realized price is now only $70 below,” he wrote alongside a summary chart.

“Price in both the 2015 and 2019 bear markets used short-term holder realized price as support, 2023 is exactly the same, testing it three times so far $28,241.”

Magazine: Should you ‘orange pill’ children? The case for Bitcoin kids books

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer. This publication is sponsored. Cointelegraph does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Cointelegraph or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Cointelegraph shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.

Comments

Post a Comment