El Salvador is now in $200 million profit on their Bitcoin bet

El Salvador is now reaping the rewards of its decision to invest strategically in Bitcoin (BTC) after declaring the digital asset a legal tender.

The investment has registered significant profits, which have spiked following Bitcoin’s new all-time high of $80,000, buoyed by the United States post-election rally.

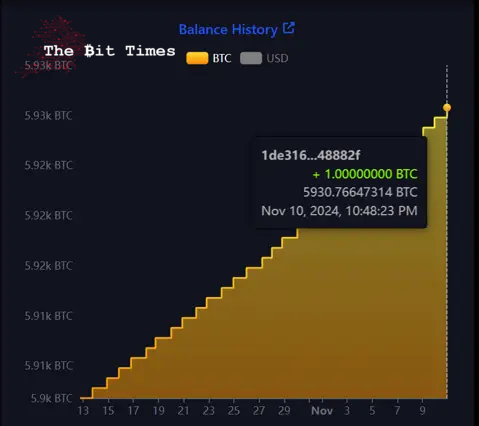

As of November 10, the country was holding approximately 5,930.77 BTC, valued at around $471.18 million based on market rates as of press time, according to data retrieved by Finbold from El Salvador’s Bitcoin Office.

Picks for you

To this end, El Salvador’s Bitcoin holdings have generated an unrealized profit of about $203.10 million, representing a 75% gain on its investment. Most of the profits have been realized in 2024 with returns of $196.33 million or 71% year-to-date.

The government purchased its first Bitcoin on September 6, 2021, acquiring 400 BTC for $46,811 per coin. Since then, El Salvador has accumulated more Bitcoin with cumulative holdings purchased at an average price of around $45,223, reflecting a total investment of $268,08 million.

The most recent purchase was recorded on September 30, involving the acquisition of 492 BTC at $65,707 per coin. Among the purchases, the transaction completed on July 1, 2022, which involved 80 BTC, boasts the highest return rate for a single transaction at 325%.

It’s worth noting that since November 2022, El Salvador has implemented a “1 Bitcoin per Day” program, purchasing 1 BTC daily regardless of the market value.

El Salvador’s Bitcoin holdings could be worth more, considering that authorities are also mining through various technologies, such as leveraging volcanic energy. In 2024 alone, the country has mined at least 470 Bitcoins.

Impact of El Salvador’s Bitcoin strategy

If the country realized profits from its Bitcoin investments, it would substantially boost the economy. However, this option is currently not viable, as President Nayib Bukele is promoting a ‘buy-and-hold’ strategy to establish the country as a crypto-friendly nation.

Meanwhile, the Bitcoin journey has not been without criticism. As reported by Finbold, the International Monetary Fund urged the country to scale down its cryptocurrency law, reduce public exposure to the asset, and implement more regulation.

From the onset, the IMF has been critical of the Bitcoin decision, warning of potential economic risks. This concern has been complicated further because a significant number of residents believe the Bitcoin strategy has failed.

Other countries with Bitcoin holdings

Overall, El Salvador is among the countries holding Bitcoin through strategic purchases. Recently, it was revealed that the small nation of Bhutan has been secretly accumulating the flagship digital asset, with its holdings now valued at approximately $1 billion.

Other countries also hold significant amounts of Bitcoin, often through seizures. The United States leads with Bitcoin valued at around $16 billion, mainly from the Silk Road seizure.

China ranks second with over $15 billion in holdings, while the United Kingdom holds nearly $5 billion. Ukraine also has substantial Bitcoin, primarily acquired through donations to aid in its conflict with Russia.

Although El Salvador’s Bitcoin accumulation is crucial to the asset’s overall growth, concerns remain about the potential impact on the broader crypto market if the country were to sell. Selling such a significant amount could indeed trigger substantial volatility.

Featured image via Shutterstock

Comments

Post a Comment