Price prediction for Chainlink (LINK) amid 50% gains opportunity

Chainlink (LINK), the leading Oracle blockchain in the market, has promising potential as tokenization of real-world assets (RWA) gets mainstream. Now, on-chain Analysis indicates LINK could set for a 50% gain opportunity from current prices for the following weeks.

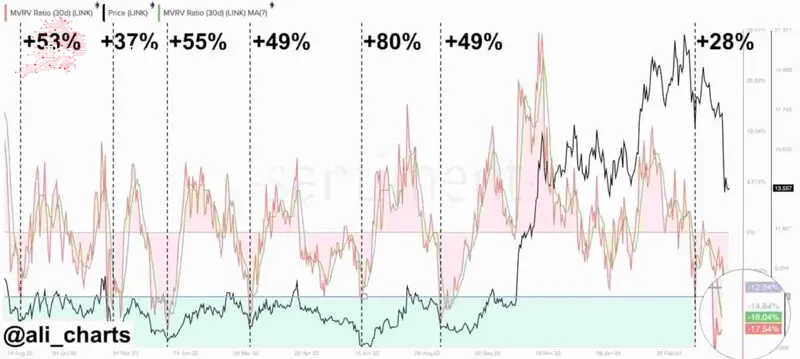

Ali Martinez, who goes by @ali_charts on X (formerly Twitter), posted the Chainlink Analysis on April 17. In particular, Martinez highlights historical patterns involving the 30-day Market Value to Realized Value (MVRV) relation to LINK’s price.

“Each time Chainlink MVRV 30-Day Ratio has dropped below -12.24% since August 2022, it’s signaled a prime buying opportunity, averaging 50% returns! Currently, LINK MVRV 30-Day Ratio stands at -17.54%. This could be another chance to buy the LINK dip!”

– Ali Martinez

Picks for you

Notably, LINK has gained 53%, 37%, 55%, 49%, 80%, and 49% each time this pattern played out. Should this pattern repeat, Chainlink investors could accrue significant returns from the current exchange rate.

Chainlink (LINK) price analysis: 50% gains incoming?

LINK trades at $13.24 as of writing, testing a key short-term support level. Previously, this level supported Chainlink’s price for a few days in November 2023 and January 2024.

However, the 50-day exponential moving average (EMA) was an important reference point, strengthening the observed support level, which has changed. LINK lost the 50-EMA that currently fluctuates around $17.45 per token.

Furthermore, the Relative Strength Index (RSI) also suggests a different scenario, showing a bearish outlook under weak momentum. On the other hand, the current oversold daily RSI is often seen as a buy signal.

In summary, Ali Martinez has spotted a solid on-chain historical pattern that suggests a potential 50% for Chainlink moving forward. Such a rally could propel LINK to nearly $20, testing a psychological resistance above the 50-day EMA.

Technical indicators display a bearish sentiment for the token, but going to extremes could forecast a potential shift. The cryptocurrency market remains uncertain, and its natural volatility brings risks and opportunities for speculators trading cryptocurrencies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment