Buy signal for two cryptocurrencies with negative funding rates

Two cryptocurrencies among the highest open interests in the market currently have negative funding rates, potentially indicating a buy signal.

The negative funding rates mean short-sellers must pay an interest rate to long-position traders for as long as they keep the short positions open. Therefore, these traders could face liquidation through a short squeeze or be forced to close their positions, potentially impacting prices.

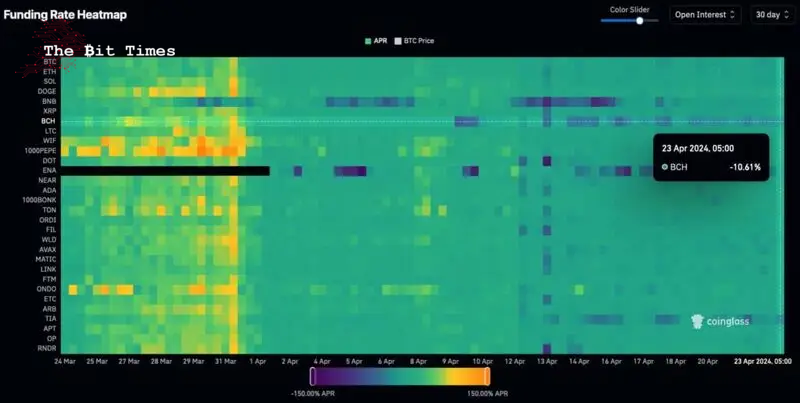

Looking for insights, Finbold turned to CoinGlass‘s funding rates heatmap on April 23. We ordered the chart by cryptocurrencies with the highest open interest (OI) and spotted two possible buy signals to consider.

Picks for you

Bitcoin Cash (BCH) short squeeze

In particular, Bitcoin Cash (BCH) ranks as the seventh largest cryptocurrency by open interest, with only the 14th largest capitalization. The popular Bitcoin (BTC) competitor has around $337 million in open interest while holding a $10 billion market cap.

As for the funding rates, BCH has the most significant negative APR among the top 10 cryptocurrencies by OI. With a negative 10.61% funding rate, short-sellers might be pressed to close their positions.

Interestingly, Bitcoin Cash has seen an increase in upward liquidity pools due to leveraged liquidation accumulations. As reported by Finbold, this has triggered a short squeeze alert for this week. So far, BCH has not yet been squeezed, which increased the potential of the above negative funding rates buy signal.

By press time, the maiden cryptocurrency was trading at $510, with a potential surge to above $700.

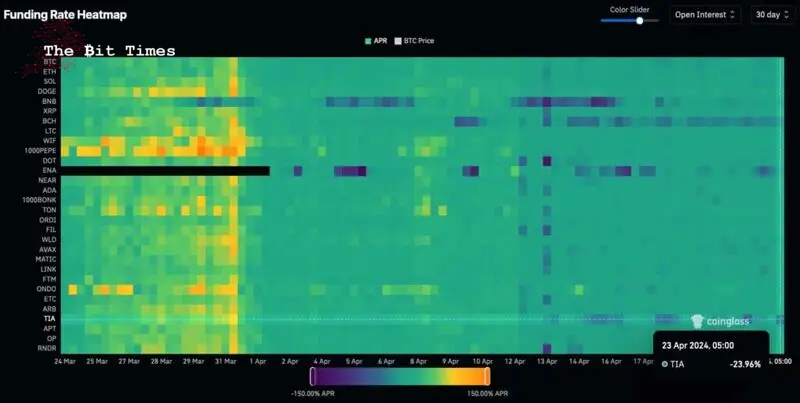

Celestia (TIA) negative funding rates

The next most relevant negative funding rates buy signal goes for Celestia (TIA), with nearly 24% APR. Celestia occupies the 27th position by open interest.

However, unlike Bitcoin Cash, the layer-1 blockchain native token has a neutral liquidation heatmap, which weakens the buy signal even with the high observed funding rate. Finbold previously reported a sell signal for Celestia due to overbought conditions.

This is a clear demonstration of how unpredictable the cryptocurrency market is. Crypto traders must consider different factors to make profitable decisions while remaining cautious and having a solid risk management strategy.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment